Effective interaction between customers and customs brokers is the key to smooth transportation and delivery of goods. However, brokers often use professional jargon when negotiating, discussing contract details, and describing logistics processes. In order to help you clearly understand what your broker is saying and to be aware of all the nuances of your transaction, we have prepared this useful glossary of brokerage terms.

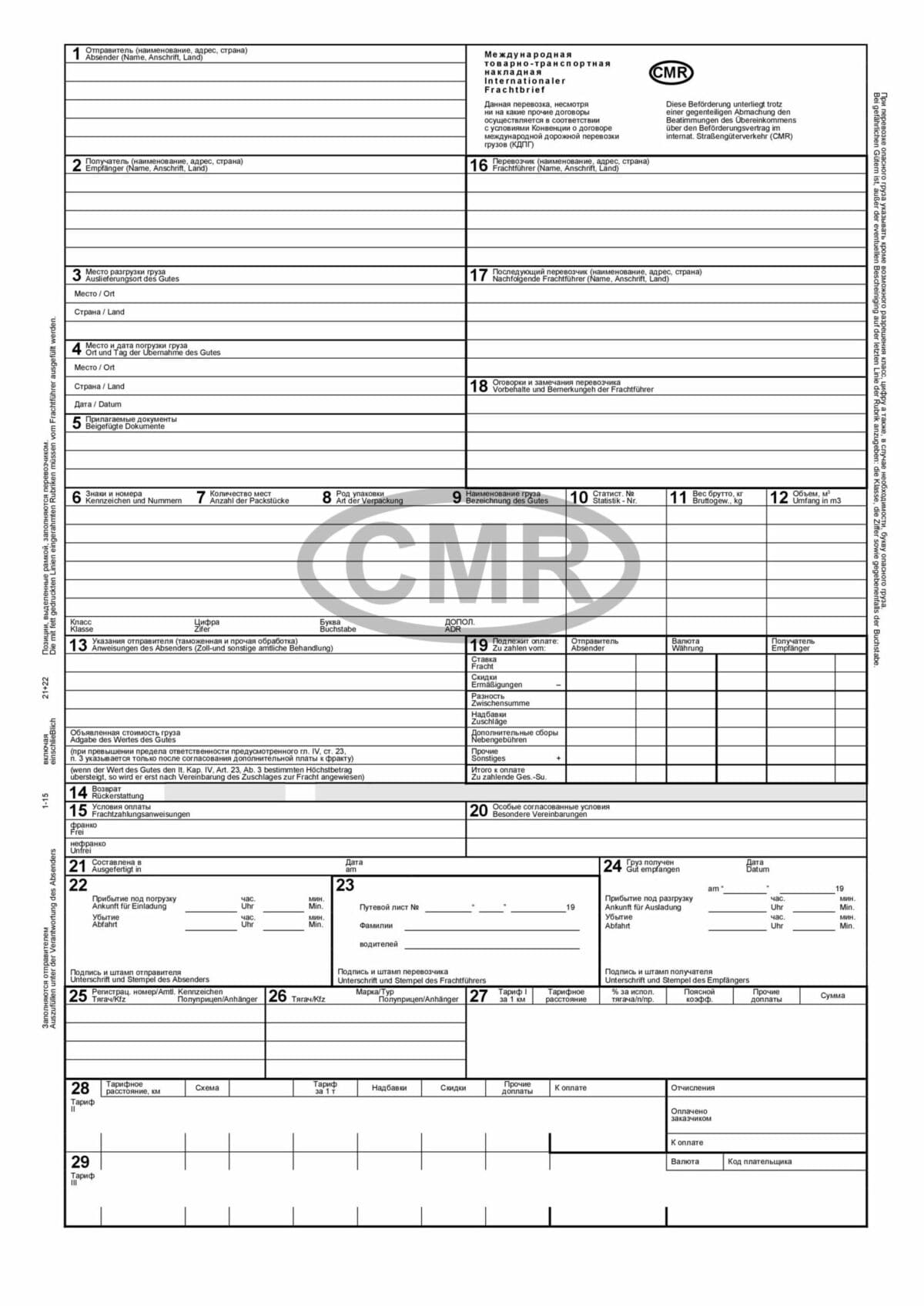

CMR is a consignment note that contains information about the cargo, the names of the sender and consignee companies, the route of transportation, etc. The CMR is the main document in international road freight transportation, confirming the conclusion of a transportation contract between the seller, carrier and customer.

Sample CMR consignment note

Customs accreditation is a formal process of recognizing a company or individual as a foreign economic operator (FEO) and/or customs broker with the relevant customs authority. As a result, the company or individual receives a foreign economic activity registration number, which is then used for identification and customs procedures.

A foreign economic contract is a legal document that regulates relations between parties (buyer and seller) located in different countries regarding the sale and purchase, delivery of goods, performance of works or provision of services.

T1 (T1 Transit Document) is a transit declaration used for transit operations within the European Union. The T1 declaration allows goods to be transported between the customs offices of EU countries without paying duties and other fees until the goods arrive at their final destination within these countries.

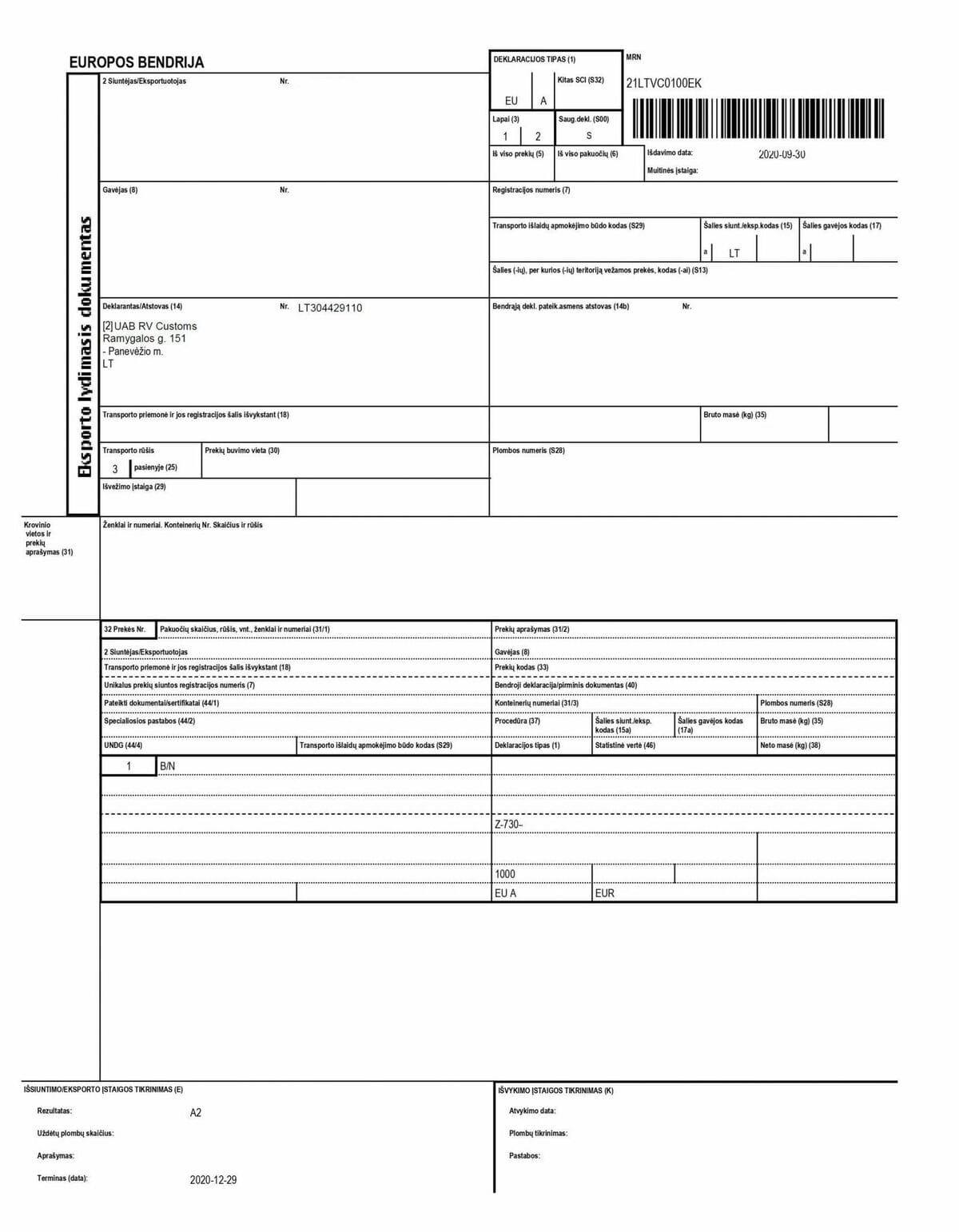

Export declaration (EX-1) is an official document that confirms the export of goods outside the EU. It is important for customs control and may be required for international cargo transportation. The EX-1 helps to avoid double taxation and facilitates the proper documentation of export operations.

Export declaration form EX-1

An invoice is a commercial document issued by a seller to a buyer. It reflects the quantity of goods, unit price, total amount, payment terms, seller and buyer information, and other important information related to the transaction.

The packing list accompanies the shipment of goods and provides details about the contents of the shipment. It may contain information about the types and quantity of goods, weight, dimensions, etc.

A trademark is a unique sign (logo, name, word, phrase, symbol, or a combination of these elements) that is used to identify the goods or services of a particular manufacturer or supplier in the marketplace. Trademarks are legally protected. That is, other companies cannot use the same or similar marks if it could confuse consumers about the manufacturer of the goods or services.

Intellectual property (IP) is the result of the creative or intellectual work of one or more people. Understanding IP is important for moving goods across borders easily and avoiding legal problems with cargo.

Objects of intellectual property rights

VAT (Value Added Tax) is a tax on value added. It is imposed on the cost of goods and services at each stage of the production and distribution process.

Deferred VAT allows companies to postpone the payment of value added tax until a certain point in the future, usually until the goods are sold. This system operates in the UK. In some cases, companies can recover deferred VAT (VAT refund), especially if they carry out transactions that are subject to VAT-free circulation, such as international trade.

The UKTZED code refers to a specific product or group of products in the Ukrainian Classification of Goods for Foreign Economic Activity (UKTZED). The UKTZED is a systematized list of goods where each product has its own unique code and name. This simplifies the processes of customs clearance and calculation of customs rates.

Customs declaration is an official document that is submitted to the customs authorities when importing or exporting goods across the customs border.

Customs declaration form MD-2

SWIFT is a system for making international payments. You can send SWIFT payments to partners, suppliers, or logistics companies.

The preliminary declaration is used only to control the delivery of goods to the specified domestic customs office. It contains information about goods imported to Ukraine for any purpose other than transit.

EUR.1 is a certificate of transportation of goods, which certifies that the goods are manufactured in Europe or Ukraine and allows to reduce the duty when importing goods into the recipient country. This helps to reduce the price of goods for the buyer.

The Phytosanitary Certificate confirms the compliance of the regulated objects (plants, plant products, soil, etc.) with the phytosanitary requirements of the recipient country. This document is issued by the State Phytosanitary Service of Ukraine after inspection, examination and phytosanitary expertise of the goods.

We hope this glossary will be useful to you and help you navigate the world of customs brokerage services. The DiFFreight team is always ready to help you organize international transportation and customs clearance. Don't hesitate to contact us!